The housing market is constantly evolving, influenced by economic shifts, interest rates, demographic changes, government policies, and consumer preferences. Staying informed about housing market trends and updates is essential for buyers, sellers, and investors to make smart decisions in today’s competitive real estate landscape.

1. Current Housing Market Overview

Recent reports indicate a moderate slowdown in housing sales in many regions, largely due to rising mortgage rates and affordability pressures. Despite this, demand for well-located homes with modern amenities remains strong. Inventory levels are gradually increasing, giving buyers more options but also creating pricing pressure for sellers.

Key insight: While some markets are cooling, others—especially suburban and secondary cities—are seeing strong growth due to lifestyle changes and remote work flexibility.

2. Interest Rates and Financing Updates

Interest rates continue to play a critical role in shaping housing market trends and updates. Higher rates have slightly reduced affordability, leading many buyers to delay purchases or explore adjustable-rate mortgages. Refinancing activity has decreased, while first-time buyers are seeking creative financing options to enter the market.

Tip: Monitor mortgage rates closely and work with lenders to explore the best available options. Locking rates early can protect against future increases.

3. Affordability Challenges

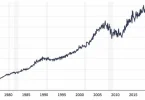

Home prices have risen significantly in the past few years, creating affordability challenges for many households. The rise in construction costs, limited supply, and strong demand have contributed to this trend. Some buyers are shifting to smaller homes, condos, or suburban locations to balance cost with lifestyle needs.

Tip: Explore emerging neighborhoods or consider fixer-upper homes to find affordable options in competitive markets.

4. Technology and Real Estate Innovations

Technology is reshaping the housing market:

- Virtual tours and 3D walkthroughs make property shopping easier and safer.

- AI-driven pricing tools help buyers and investors assess fair market value.

- Online platforms streamline buying, selling, and rental processes, increasing transparency and efficiency.

Implication: Technology is making the market more accessible, but buyers and sellers should verify details and not rely solely on digital impressions.

5. Shifts in Buyer Preferences

Housing market trends and updates show a shift in what buyers prioritize:

- Suburban living: Families are moving to suburbs for more space, affordability, and better schools.

- Home offices: Remote work continues to drive demand for dedicated workspaces.

- Energy efficiency: Buyers increasingly seek green homes with sustainable features.

- Flexible spaces: Homes with bonus rooms, basements, or adaptable layouts are preferred.

Tip: Sellers who adapt their properties to these preferences may achieve faster sales and higher offers.

You may also like it:

Steps to Buy Your First Dream Home | Complete Guide

Affordable Home Buying Options Online: Complete Guide

First Time Home Buyer Guide | Step-by-Step Buying Tips

Latest Real Estate Trends 2026: Key Insights & Opportunities

6. Rental Market Trends

The rental market has also evolved alongside homeownership trends:

- Demand for rental properties remains strong in urban areas and college towns.

- Short-term and furnished rentals are gaining popularity for flexibility.

- Rising rents in many regions make rental investments appealing for long-term cash flow.

Tip: Investors can benefit from understanding rental demand patterns and local regulations before acquiring rental properties.

7. Regional Market Differences

Housing market trends and updates vary significantly by region:

- Urban centers: Moderate growth due to remote work reducing city density demand.

- Suburbs: Strong growth as families seek more space and affordable living.

- Secondary cities: Emerging as attractive investment and relocation options due to affordability and job opportunities.

Advice: Research local market conditions thoroughly, as national trends may not reflect regional realities.

8. Government Policies and Market Impact

Government interventions, such as first-time buyer incentives, property tax adjustments, and zoning reforms, continue to shape housing markets. These policies can stimulate demand or create regulatory barriers depending on implementation.

Tip: Stay updated on local and national housing policies to take advantage of benefits or navigate restrictions effectively.

9. Investment Opportunities

The evolving housing market presents opportunities for investors:

- Build-to-rent and multi-family housing are gaining traction.

- Green or energy-efficient properties often yield higher resale value.

- Emerging neighborhoods in secondary cities offer long-term appreciation potential.

Advice: Diversify investment strategies and focus on high-demand sectors aligned with current trends.

10. Outlook for the Coming Year

Experts predict moderate price growth in many regions, continued demand for suburban and flexible housing, and increased adoption of technology in real estate transactions. Affordability challenges may persist, but opportunities for buyers and investors exist in well-researched markets.

Conclusion

Staying informed about housing market trends and updates is essential for navigating today’s real estate landscape. Buyers, sellers, and investors who understand market dynamics, embrace technology, and adapt to changing preferences will be well-positioned for success.

FAQs

Q1: What are the current housing market trends?

A1: Current trends include rising interest rates, affordability challenges, suburban migration, flexible housing preferences, and growing use of technology in real estate.

Q2: How are interest rates affecting the housing market?

A2: Higher mortgage rates have slowed buying activity, reduced refinancing, and pushed some buyers toward adjustable-rate loans or more affordable neighborhoods.

Q3: What are buyers looking for in 2026?

A3: Buyers prioritize suburban locations, larger spaces, home offices, energy-efficient features, and adaptable layouts to accommodate modern lifestyles.

Q4: How is technology changing the housing market?

A4: Virtual tours, AI-driven pricing, online property platforms, and digital transaction tools are streamlining buying, selling, and rental processes.

Q5: What regions are seeing the most growth?

A5: Suburbs and secondary cities are growing due to affordability and lifestyle appeal, while some urban centers experience moderate growth or slower demand.