In today’s fast-evolving property market, understanding property price trends in real estate has become essential for anyone planning to buy, sell, or invest. Real estate prices do not move randomly—they follow patterns shaped by economic cycles, demand, government policies, infrastructure development, and regional growth. By studying these price trends, individuals can make smart and profitable decisions while avoiding risks.

Whether you are a first-time homebuyer, a long-term investor, or a property consultant, knowing how property prices behave over time will give you a competitive edge.

This guide explores everything you need to know about property price trends, including factors influencing prices, current market patterns, future forecasts, and expert tips.

What Are Property Price Trends?

Property price trends refer to the direction in which real estate prices move over time—whether they rise, fall, or stay stable. These trends are influenced by multiple factors such as supply and demand, interest rates, government policies, and local infrastructure development.

By observing these trends, buyers and investors gain insights into market behavior and identify the best opportunities to enter or exit the market.

Why Property Price Trends Matter

1. Helps Buyers Choose the Right Time to Purchase

Knowing whether prices are increasing or decreasing can help buyers avoid overpaying and secure a better deal.

2. Guides Investors Toward Profitable Locations

Investors rely heavily on property price trends in real estate to identify high-growth areas that offer strong returns.

3. Improves Financial Planning

Tracking price movement helps individuals understand how much they need to save and the long-term value of their investment.

4. Reflects Market Stability

Consistent price growth usually signals a healthy real estate market, while sudden drops may indicate economic uncertainty.

Major Factors Influencing Property Price Trends in Real Estate

Property prices are shaped by various interconnected forces. Below are the most influential:

1. Supply and Demand Gap

One of the strongest drivers of property prices is the balance between supply and demand:

- High demand + low supply = Rising prices

- Low demand + high supply = Stable or falling prices

For example, cities with increasing population and limited land often experience continuous price hikes.

2. Economic Growth and Inflation

When the economy grows:

- People’s buying power increases

- More jobs are created

- Demand for housing rises

This pushes property prices higher.

Inflation also affects construction costs, which directly increases the price of new homes.

3. Interest Rates and Mortgages

Low interest rates make loans cheaper, encouraging more people to buy homes. This increases demand and pushes prices up.

High interest rates have the opposite effect—they cool down the market.

4. Infrastructure Development

Areas with major infrastructure upgrades experience a strong rise in property prices. Examples:

- New highways

- Metro routes

- Airports

- Commercial hubs

- Schools and hospitals

- Shopping malls and entertainment centers

Infrastructure increases accessibility, boosting property demand.

You may also like it:

Best Property Listings for New Buyers 2025

Steps to Buy Your First Dream Home | Complete Guide

Affordable Home Buying Options Online: Complete Guide

5. Urbanization and Migration Trends

Large cities attract job seekers, increasing the need for housing. This results in long-term price growth.

Similarly, suburban areas near big cities also see rising prices as people shift toward the outskirts for affordable living.

6. Government Policies and Tax Benefits

Policies such as:

- Housing schemes

- Subsidies

- Tax deductions

- Relaxed construction rules

- Lower interest rates for first-time buyers

can significantly impact price trends by increasing buying activity.

7. Real Estate Market Sentiment

Market expectations often drive real prices. If people believe prices will rise soon, demand increases, and prices actually rise.

Positive sentiment keeps the market active.

Current Property Price Trends in Real Estate (Global Overview)

While every region differs, some common global trends include:

1. Strong Growth in Major Urban Cities

Big cities continue to witness strong demand due to:

- Employment opportunities

- Education facilities

- Limited land

- Better lifestyle options

This leads to steady appreciation in property values.

2. Rising Popularity of Suburbs and Outskirts

Post-pandemic trends show a shift toward areas:

- With bigger homes

- More greenery

- Lower prices

- Less crowding

These areas have experienced strong price growth as people prioritize space and affordability.

3. Increased Demand for Commercial Properties

Business expansion, retail growth, and rising entrepreneurship have made commercial real estate highly profitable, resulting in upward price trends.

4. Growth of Smart Homes and Gated Communities

Smart homes equipped with advanced technology, security, and energy efficiency are attracting buyers willing to pay higher prices.

5. Luxury Market Stability

Luxury properties in prime locations continue to show stable, moderate growth due to limited supply and high-net-worth demand.

How to Analyze Property Price Trends (Expert Guide)

Analyzing trends like a professional requires a combination of research and observation.

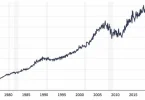

1. Study Historical Pricing Charts

Check how prices have behaved over the last 5–10 years.

Steady, consistent growth indicates a healthy market

2. Compare Multiple Localities

Price comparison helps identify undervalued areas with high future potential.

3. Follow Local Development Plans

Government development authorities often publish:

- Master plans

- New project approvals

- Road expansion proposals

These directly impact future prices.

4. Track Rental Yield Trends

Areas with high rental demand often show strong long-term price appreciation.

5. Monitor Market News and Reports

Industry reports, real estate portals, and economic updates provide reliable trend data.

6. Consult Real Estate Professionals

Agents, consultants, and developers have deep knowledge of local price movements.

Future Outlook for Property Price Trends

Experts predict the following:

- Prices in urban areas are expected to grow steadily due to limited land.

- Suburbs will continue gaining popularity due to affordability.

- Commercial real estate demand will rise with economic growth.

- Eco-friendly and smart home projects will attract premium pricing.

- Digital real estate tools will make price forecasting more accurate.

Overall, the property price trends in real estate indicate long-term growth driven by development, technology, and increasing housing demand.

Final Thoughts

Understanding property price trends in real estate is essential for making informed buying and investment decisions. By following market data, economic signals, development plans, and buyer behavior, you can easily identify the best time and place to invest. Whether you are a first-time buyer or a seasoned investor, staying updated on these trends will help you maximize your returns and avoid unnecessary risks.

FAQs

1. What are property price trends in real estate?

They are the patterns that show how property prices rise, fall, or remain stable over time.

2. Why are property price trends important?

They help buyers and investors choose the right time and location to invest.

3. What factors affect property prices?

Supply and demand, interest rates, economic conditions, infrastructure, and government policies.

4. Do property prices always increase?

Not always. Prices may fall during economic downturns or when supply exceeds demand.

5. How can I track property price trends?

By checking market reports, real estate websites, news updates, and historical price charts.